Climate-Related Risk Management and Response Measures

As one of the most influential financial institutions in Taiwan, Nan Shan Life is dedicated to keeping up with global sustainability trends and proactively responding to the potential business impacts of climate change. The Company will continue to implement its climate change strategies based on the four pillars of the TCFD framework. We also identify and respond to major climate-related risks and opportunities, enhancing the Company’s climate resilience by setting up indexes, goals, and regular follow-up schedules. For a full content of the identification of risks and opportunities associated with climate change, please refer to Chapter 4.1.1 in the 2023 Sustainability Report .

Climate Governance

Supervision by the Board of Directors

The Board of Directors is the highest supervisory authority for climate change issues at Nan Shan Life. The Board of Directors is not only responsible for approving and reviewing climate-related strategies, but also supervises climate change actions and performance-related indexes. The Board of Directors evaluates climate-related risks and opportunities in relation to the Company’s strategies and adaptation plans by incorporating them into the operation and investment management structure.

The functional committees, Risk Management Committee, and Corporate Sustainability Committee are under the jurisdiction of the Board of Directors, oversee the respective management and execution of climate change-related risks and opportunities.

The Company develops a climate risk appetite statement in line with Taiwan's 2050 net zero emissions pathway announced by the government. Besides, based on the Science-based Target (SBT) commitment, the Company will continue to assess the exposure of the Company's assets and liabilities to physical and transition risks in order to continuously refine its climate risk management capabilities.

The functional committees, Risk Management Committee, and Corporate Sustainability Committee are under the jurisdiction of the Board of Directors, oversee the respective management and execution of climate change-related risks and opportunities.

The Company develops a climate risk appetite statement in line with Taiwan's 2050 net zero emissions pathway announced by the government. Besides, based on the Science-based Target (SBT) commitment, the Company will continue to assess the exposure of the Company's assets and liabilities to physical and transition risks in order to continuously refine its climate risk management capabilities.

Senior Management

The President supervises and assigns the relevant departments or working groups to be responsible for the management of climate-related risks and opportunities, and continuously monitors the management and disclosure of climate-related risks and opportunities. The Risk Management Department coordinates the TCFD working groups to report to the President, Risk Management Committee and the Board of Directors on the management of climate-related risks; the Strategic Planning Department coordinates the Corporate Sustainability Executive Team to report to The President, Corporate Sustainability Committee and the Board of Directors on the management of climate-related opportunities.

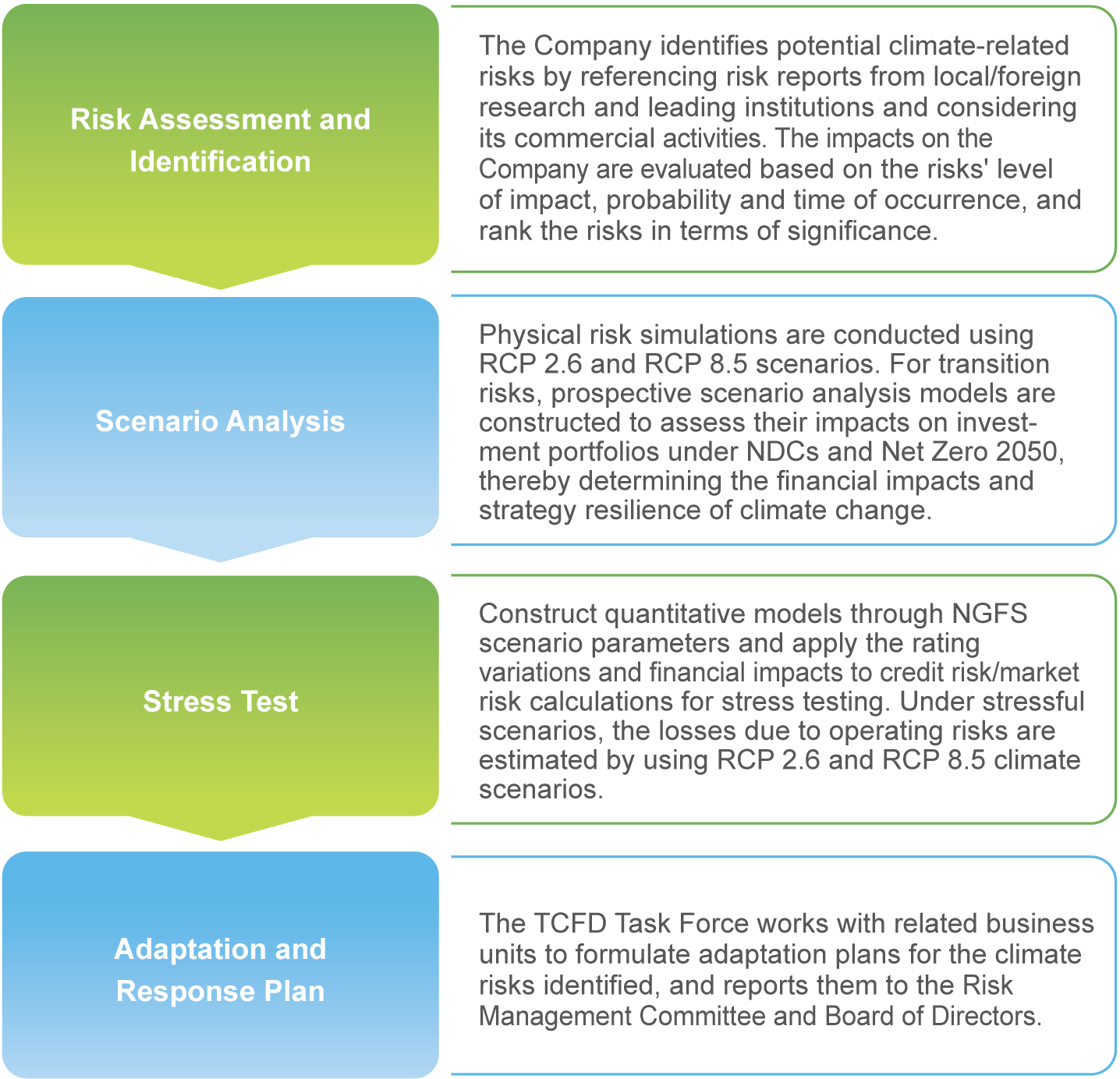

Climate-Related Risk Management Structure

Nan Shan follows the TCFD recommendations and Taiwan's Financial Disclosure Guidelines for Climate-related Risks in the Insurance Industry in establishing a climate-related risk management and control mechanism. In addition to regularly identifying climate-related risks, Nan Shan also evaluates the business and financial impacts of these risks to develop corresponding countermeasures. Furthermore, Nan Shan incorporates climate-related risks into the current risk management structure and divides rights and responsibilities according to the three lines of defense of internal control. By doing so, Nan Shan ensures all climate-related risks are well monitored.

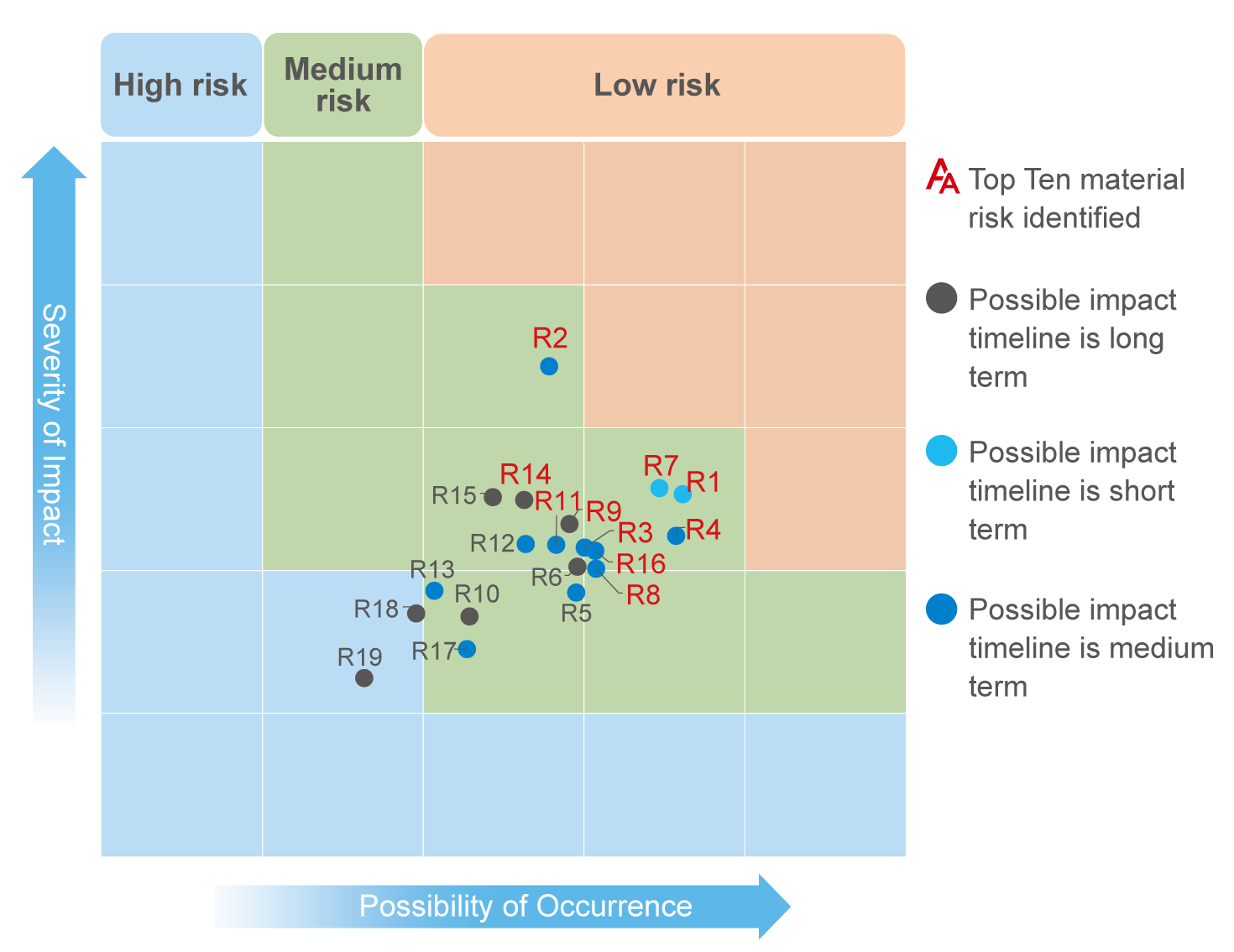

Climate-Related Risks Identification Results

By referring to the analysis reports released by domestic and foreign research and benchmark companies, and taking into account our own business characteristics, our TCFD Task Force identified and summarized 19 climate-related risks (including physical and transition risks) that the Company may face in the future, evaluated their possibility of occurrence, impact degree and possible timeline (short, medium and long term), and ranked them in terms of significance. In 2023, we identified ten climate-related risks with higher significance, including three physical risks and seven transition risks, and proposed relevant response measures.

Climate-related Material Risks and Adaptation Action Plans

-

R1 Policy requirements to increase the proportion of renewable energy

Risk Description Adaptation Action Plan The Company needs to increase the use of renewable energy in response to legal, client, and international initiatives. These changes will increase the operating costs. - In 2023, Nan Shan Life's self-owned buildings, Taichung Education and Training Center, and Tainan Xinshi Industrial Park will use solar power generation systems for self-use purpose. The capacity will reach 1,310.14KW, with an estimated annual power generation of about 1.5 million kilowatt hours, which will reduce carbon emissions by approximately 742.5tCO2e

- According to the signed SBT, the reduction of carbon emissions in scopes one and two is 42% by 2030 (the base year is 2022), and the proportion of renewable energy use will be increased

- Continue to evaluate the feasibility and benefits of installing photovoltaic power generation equipment in self-owned buildings

-

R2 Policy requirements to increase the proportion of green buildings

Risk Description Adaptation Action Plan The Company needs to increase the proportion of green buildings in response to related regulations and tenant expectations. These changes will increase operating costs. - Continue to increase compliance with green building standards in the development process of future new construction projects

- Replace LED lighting fixtures and other daily energy-saving indicators in existing buildings

-

R3 Transition-related legal risks may have financial impacts on the investment targets

Risk Description Adaptation Action Plan As the net-zero carbon emission policies become more stringent around the world, the environmental performance indicators of the investment targets may become poorer, which may affect the valuations of the investment targets, leading to the Company’s investment losses and financial health deterioration. - Regularly evaluate the impact on the Company’s capital employment caused by its investment in the high carbon emission list.

-

R4 Increase in cost of greenhouse gas emissions

Risk Description Adaptation Action Plan With the tightening of carbon emission related policies or regulations, the cost of greenhouse gas emissions will increase, which will lead to an increase in the daily operating costs of the business locations - Nan Shan Life plans response measures (such as installing solar panels, expanding the use of renewable energy, promoting energy-saving measures, etc.) in accordance with the scientific foundation carbon reduction goals set in the signed SBTi. In 2023, the Company replaced energy-saving appliances such as LED lighting fixtures and air conditioning systems with low GHG refrigerants, and participated in Earth Hour to reduce the Company's carbon emissions generated by operational activities.

- Nan Shan General has taken measures to reduce carbon emissions generated by the Company's operational activity by switching the LED lighting in the elevator hall to the commuting mode, advocating energy-saving measures in the office (turning off lights during lunch breaks, turning off lights and air conditioning after work, and prohibiting high power consuming private appliances in the office), and gradually replacing old electrical equipment such as air conditioners and refrigerators that use non environmentally friendly refrigerants like R134a.

-

R7 Current products and services at the risk of being replaced by low carbon alternatives may require additional company costs

Risk Description Adaptation Action Plan The gradual low carbon transition may result in a smaller demand for current products and services. The Company may gradually adopt a green low-carbon approach to reduce carbon emissions from business operations. One example is the replacement of hardcopy insurance policies by electronic copies. This may increase the Company's Information Technology (IT) service costs (including system upgrade and storage expansion) - Improve the sustainability /green policy service models of agencies by promoting digital transformation and paperless sales service processes.

- Continue to develop low-carbon insurance services, promote and improve the use of electronic/mobile insurance services, reduce the costs of paper and related consumables.

-

R8 Customer behavior changes

Risk Description Adaptation Action Plan Under the trend of net zero transition, the general public develops an increasing awareness of sustainability-related issues. An insufficient promotion of sustainability/green insurance and services by the Company will result in declining market shares, leading to a loss of business, customers, and revenue. - Promote digital/mobile insurance and paperless services, and improve the sustainable/green policy services of agents to meet customer demands and respond to changes in customer preferences.

- Promote sustainable insurance products:

(1) Active preventive products (such as spillover-effect insurance policy): Increase the proportion of spillover-effect insurance policy and improve the resistance of policyholders through proactive prevention to reduce disease. Nan Shan Life has designed products with health management reward mechanisms to encourage policyholders to engage in independent health management, and provide the "cashback" for policyholders

(2) Enhance insurance products to adjust to climate change (such as medical and accident-related products against diseases caused by climate change) - Nan Shan Life established the “Health Protection Circle” and collaborates with health industry partners to build the wellness and healthcare services system that assist customers becoming healthy.

- Recruit the Youth Army for Health Protection by selecting elite agents and providing them with solid education training and professional certification from medical universities. This will offer comprehensive healthcare services and information to policyholders.

- Continue to focus on sustainability issues to seize market opportunities

- Start Compass Rewrite execution plan to comprehensively review the group insurance operation process, replace and optimize the group insurance and claims system, improve electronic operations and the image of Nan Shan Life group insurance valuing green insurance

- Nan Shan General launched an integrated Nan Shan General Charging Pile Insurance in 2023, and continue to promote damage prevention to assist customers in responding to climate change risks

-

R9 Investment losses from inaccurate market and customer information

Risk Description Adaptation Action Plan Due to the Company’s vast investment holdings by its business nature, the increase in the environmental sustainability awareness and real estate related risks in the future may directly affect the market value of the investment targets, resulting in the impairment and loss of the Company’s investment values. - employment caused by its investments in the carbon intensive industry list.

- Regularly track the implementation of adaptation and response measures for high-risk real estate assets

- Incorporate climate risk factors into the design of new buildings, and incorporate environmental sustainability into property operation management, provide real estate products in line with environmental sustainability

-

R11 Increased insurance claims from insured targets suffering from climate-related damages

Risk Description Adaptation Action Plan The Company's insured targets in high physical risk locations may be damaged by climate disasters, such as personnel or property damages from typhoons or heavy rainfalls. This increases both the frequency and cost of insurance claims. - To avoid the impact of climate risks on the insured subject, which may lead to an increase in claims, Nan Shan General provides damage prevention services for large corporate customer. Engineers provide customized damage prevention and survey suggestions to improve equipment operation reliability and industrial safety, strengthen prevention and ensure the continuous operation of customers

- Nan Shan General makes use of the disaster potential map for underwriting screening, and adjust reinsurance for risk transfer as needed.

-

R14 Insured targets suffer from losses due to rising sea levels

Risk Description Adaptation Action Plan For the Company’s insured subjects at high physical risk locations (e.g. by the sea or in low-lying areas), there is a higher probability for accidents and losses leading to an increase in claim costs. - Nan Shan General will make use of the disaster potential map for underwriting screening, and adjust reinsurance for risk transfer as needed.

-

R16 The power structure transformation against the increase in average temperature has led to an increase in the Company's operating costs

Risk Description Adaptation Action Plan In recent years, extreme temperatures has increased, and the average temperature will continue to rise in the future. Due to the transformation of Taiwan's power structure, it is estimated that electricity prices will gradually increase in the future, and the government will continue to promote the transformation of renewable energy. It will be necessary to purchase green electricity or renewable energy certificates to reduce the group's carbon emissions, which will increase the Company's operating costs - The Company has planned green electricity procurement and signed long-term contracts to reduce the risk of future price increases

Climate-Related Opportunities Identification Results

After completing the questionnaire and discussing with relevant departments, Nan Shan identified and reported 10 climate opportunities to the Corporate Sustainability Committee for approval. These opportunities have been categorized into eight main issues to provide a direction for the Company to detail opportunities and develop future response measures. The Company will actively contribute to climate change adaptation, grasp market trends, and connect business opportunities.

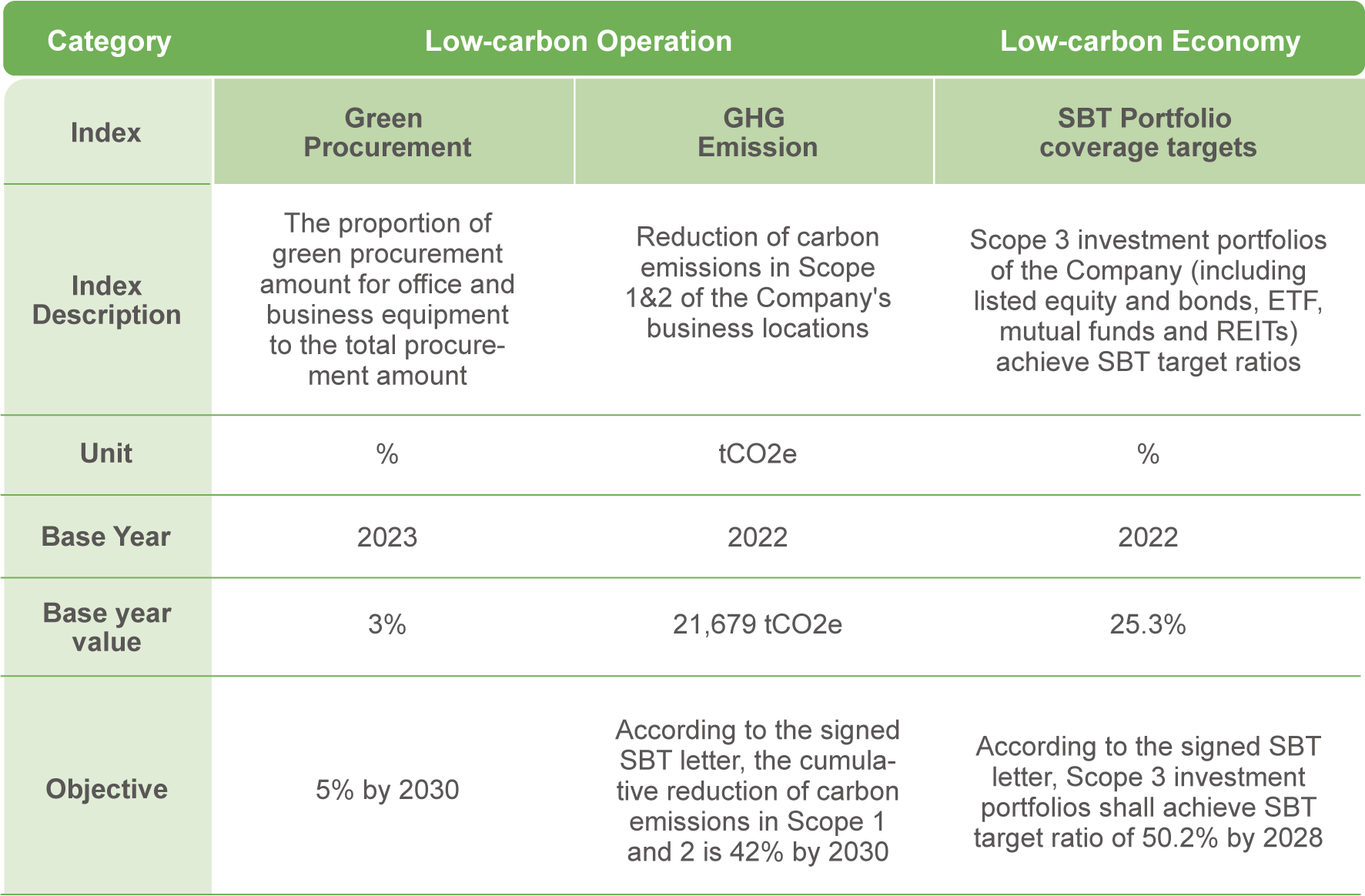

Climate Indexes and Objectives

To monitor climate risk management and respond to the government's Green Finance Action Plan 3.0, the Company actively introduces action plans such as ISO 14001 Environmental Management System, ISO 14064-1 GHG Verification, and ISO 50001 Energy Management System to its self-owned, self-use buildings. Through full-scale verification, the Company develops an effective understanding of its carbon emission and energy efficiency, and set climate management indexes and objectives as follows:

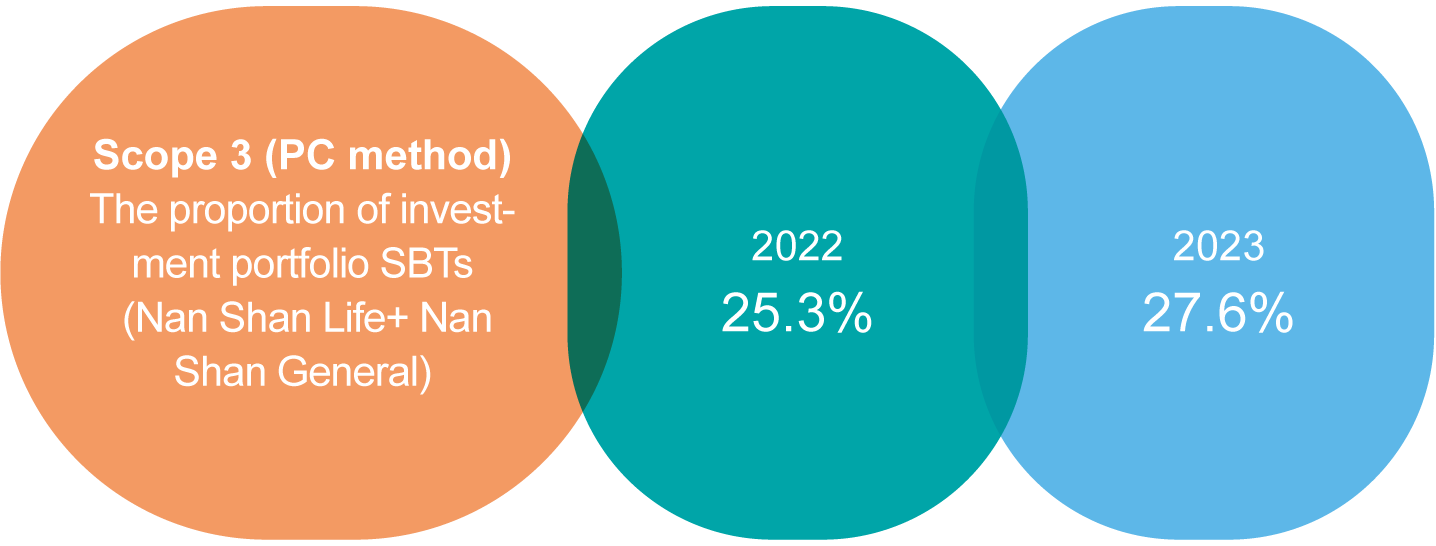

* According to the SBTi methodology, Nan Shan adopted PC method (SBT Portfolio coverage targets) for objective setting. SBT carbon reduction objectives for Scope 1, 2, and 3 listed in the table are calculated by the Company based on the SBTi methodology but not yet reviewed. The final objectives will be subject to the official SBTi review results.

** Regarding the green procurement index, as the green procurement amount in 2022 reached the original target for 2027, it is replaced by the proportion of green procurement amount for office and business equipment to the total procurement amount in order to strengthen target discrimination and facilitate tracking of climate risk management performance.

** Regarding the green procurement index, as the green procurement amount in 2022 reached the original target for 2027, it is replaced by the proportion of green procurement amount for office and business equipment to the total procurement amount in order to strengthen target discrimination and facilitate tracking of climate risk management performance.

Nan Shan Life has signed the Science based Target (SBT) letter in 2023 and completed the submission for review of the carbon reduction objectives for Scope 1, 2 and 3 by the end of the same year. The Company has included the annual performance assessment of the indexes and objectives set for climate-related risks in TCFD promotion or implementation of relevant departments, and will continue to implement the promotion and implementation of action plans. (For low-carbon operations and low-carbon economy-related actions, please refer to 4.1.2 Low Carbon Operations, 4.1.3 Low Carbon Insurance, 6.5 Sustainable Finance, Engagement Standards and Climate-related Risk Investment Management Mechanisms)

Management of low-carbon economic index

Low Carbon Operations

GHG Emission Management

Nan Shan Life introduced ISO 14064-1, one of the three main standards for the GHG management system, in 2016, and subsequently referenced 2022 as the base year in reviewing the carbon emissions from its operations every year. This gives the Company a better understanding about the main source, state, and carbon reduction strategies for its carbon emissions. Most of the GHGs produced by the Company's operation come from externally purchased electricity. Purchased electricity is the major source of GHG emissions generated by the Company’s operations. The Company achieved an inventory coverage rate of 100% in 2023 and will achieve a verification coverage rate of 100% in 2024.

Operational Energy Conservation and Carbon Reduction

To minimize the environmental impacts of its operation, Nan Shan Life actively carries out energy conservation and carbon reduction. It responds to green energy policies by setting up short-term, mid-term, and long-term goals for each environmental sustainability action plan. Some examples include office energy conservation, renewable energy system development, employees' energy efficient actions, paperless insurance policies and services. Nan Shan Life hopes to fulfill its commitment for environmental protection by reducing the amount of direct GHG emissions from its business operations.

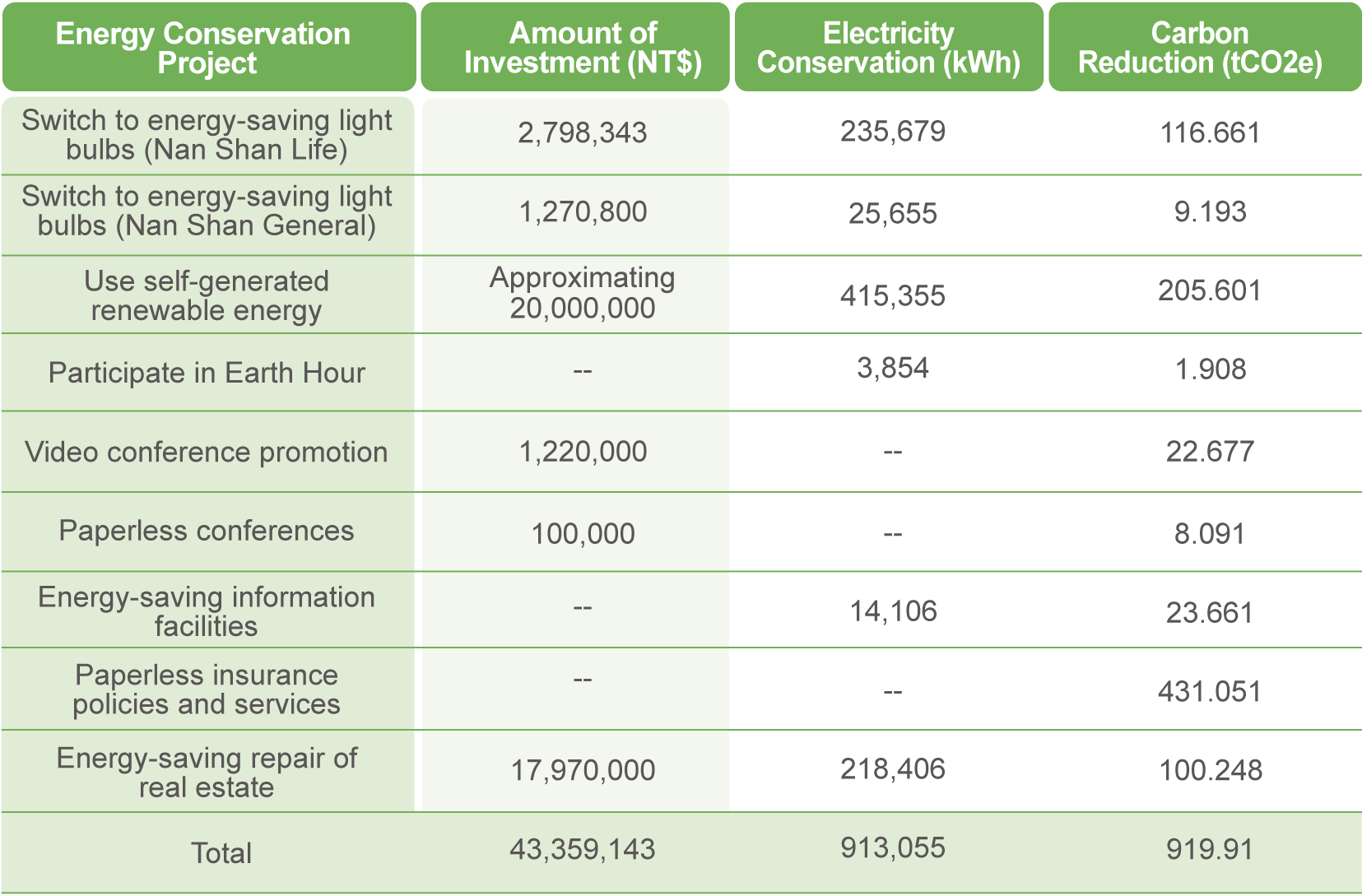

In 2023, Nan Shan Life invested nearly NT$43.35 million in operational energy conservation and carbon reduction. The estimated amount of carbon reduction was approximately 900 tCO2e.

Energy Conservation and Emission Reduction Results in 2023

In 2023, Nan Shan Life invested nearly NT$43.35 million in operational energy conservation and carbon reduction. The estimated amount of carbon reduction was approximately 900 tCO2e.

* The amount of energy conservation was calculated by: power consumption difference of old and new equipment (Watts) x number of work days in 2023 (248 days) x number of work hours (8 hours)/1,000

Renewable Energy Use

In line with Taiwan's net zero roadmap and global low-carbon transition, Nan Shan Life invested over NT$20 million in 2021 to develop green power systems. Rooftop solar power systems have been installed at Nan Shan ETC in Wuri, Taichung to generate power for self-consumption and sale back. The system installation and launch by Taiwan Power Company completed in May 2022, and the system started generating electricity. In August 2023, the Company changed ETC solar photovoltaic "balance bulk sales" to "self-use", with approximately 330,000 kWh available for ETC's own use, and the surplus electricity of about 250,000 kWh/year supplied to Taipei Nan Shan Plaza through the Taipower grid. Currently, Taipei Nan Shan Plaza is using green power from ETC. Additional 250 renewable energy certificates can be issued annually, and it is estimated that the green power used in ETC and Taipei Nan Shan Plaza will account for approximately 1.5% of the total electricity consumption.

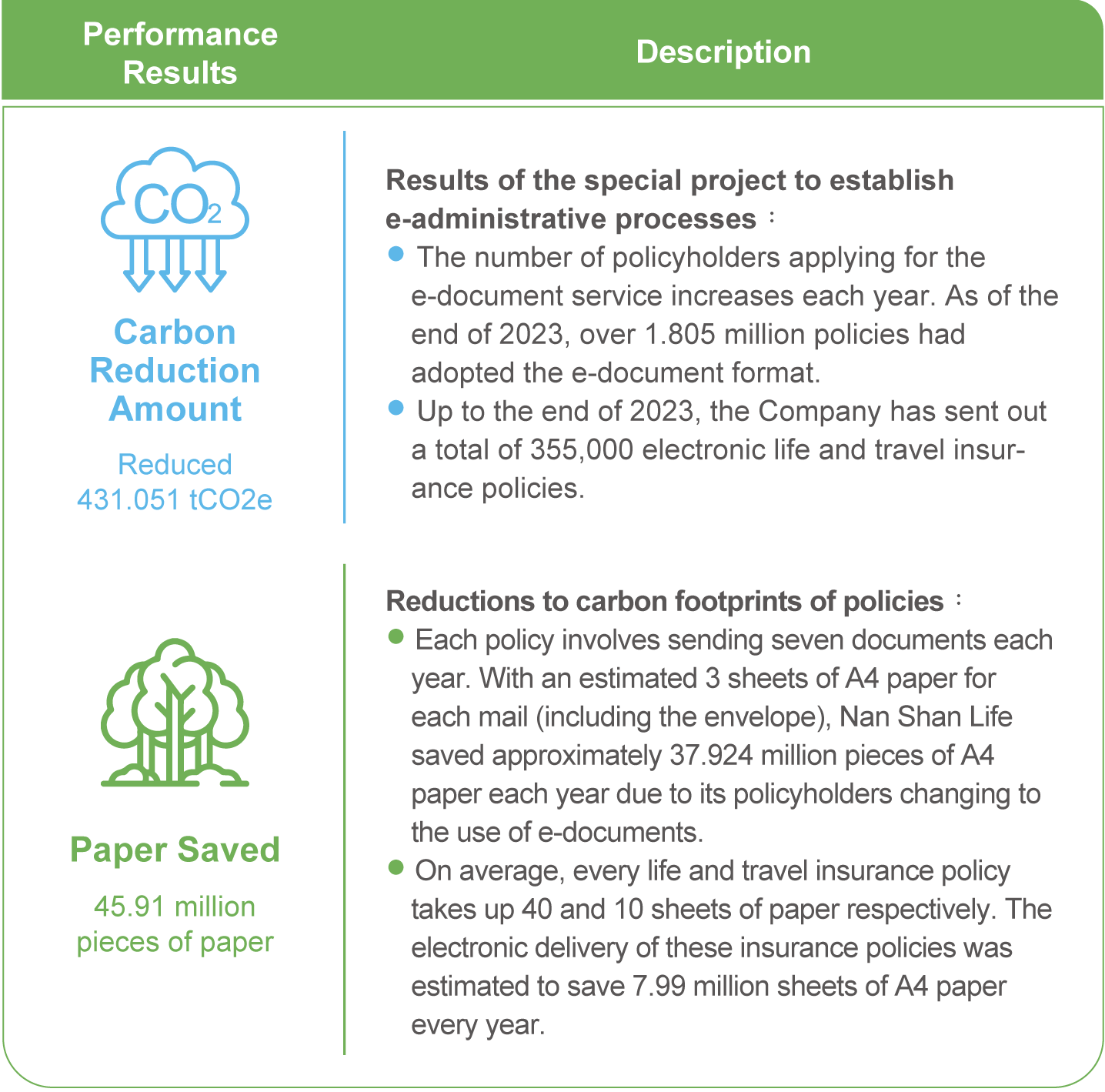

Paperless Policy and Services

Nan Shan Life has developed the Mobile Insurance Application Platform. With this platform, customers can buy insurance by signing on a tablet, reducing the use of paper. Meanwhile, the Company is making an effort to replace hardcopy documents with electronic forms and insurance policies. Instead of arranging traditional mail delivery, many receipts, notification letters, and insurance policies are now sent out electronically to achieve sustainability.

*Calculated based on the consumption of 3.8 kg-CO2e per pack of A4 paper (500 sheets) (Source: Product Carbon Footprint Information Network), the company reduced carbon emissions nearly by 348.917 tCO2e.

** According to the IPCC calculation method, the delivery of one printed billing produces about 6.32 (±0.09) g-CO2e; Nan Shan Life has mailed 12.996 million documents per year, indicating that the implementation of e-document and electronic insurance policies has saved the company 82.134 tCO2e in the mailing process alone. Totally, the company reduces 431.051 tCO2e of carbon emissions each year.

** According to the IPCC calculation method, the delivery of one printed billing produces about 6.32 (±0.09) g-CO2e; Nan Shan Life has mailed 12.996 million documents per year, indicating that the implementation of e-document and electronic insurance policies has saved the company 82.134 tCO2e in the mailing process alone. Totally, the company reduces 431.051 tCO2e of carbon emissions each year.

Green Real Estate Management

The Company continues to increase compliance with green building standards in the development process of future new construction projects. The investment real estate projects in the development stage in 2023 are involved in the right of superficies of Nan Shan Life A21 and A26 projects, both located in Xinyi District, Taipei City. The initial positioning of the products is top-level commercial offices, so both projects are planned to obtain EEWH Gold Mark, LEED Gold and WELL Gold certifications. It is expected that A21 and A26 projects will obtain relevant certifications in 2029 and 2028 respectively.

The projects in Shalun, Tamsui is also involved in right of superficies, which is mainly for self-use and partial for investment. The project is divided into two areas for development: the cultural and creative area and the parking lot. It is expected to obtain the EEWH Copper Mark in 2026 and EEWH Silver Mark in 2027 respectively. Furthermore, the Company invested over NT$17.97 million in 2023 to carry out energy-saving renovation projects on existing buildings, saving over 210,000 kilowatt hours of electricity.

The projects in Shalun, Tamsui is also involved in right of superficies, which is mainly for self-use and partial for investment. The project is divided into two areas for development: the cultural and creative area and the parking lot. It is expected to obtain the EEWH Copper Mark in 2026 and EEWH Silver Mark in 2027 respectively. Furthermore, the Company invested over NT$17.97 million in 2023 to carry out energy-saving renovation projects on existing buildings, saving over 210,000 kilowatt hours of electricity.

Low Carbon Insurance

Although the finance and insurance industry rarely creates environmental damages or pollution directly, hence Nan Shan Life makes a contribution by launching low-carbon insurance as a forerunner in the industry. From the core of insurance, the Company serves to improve the carbon footprint of its products and services. It is also dedicated to developing environment-related spillover-effect insurance products to provide policyholders with eco-friendly solutions. Nan Shan Life promotes a low-carbon economy from every aspect of its operations, services, and product designs.

Product Carbon Footprint

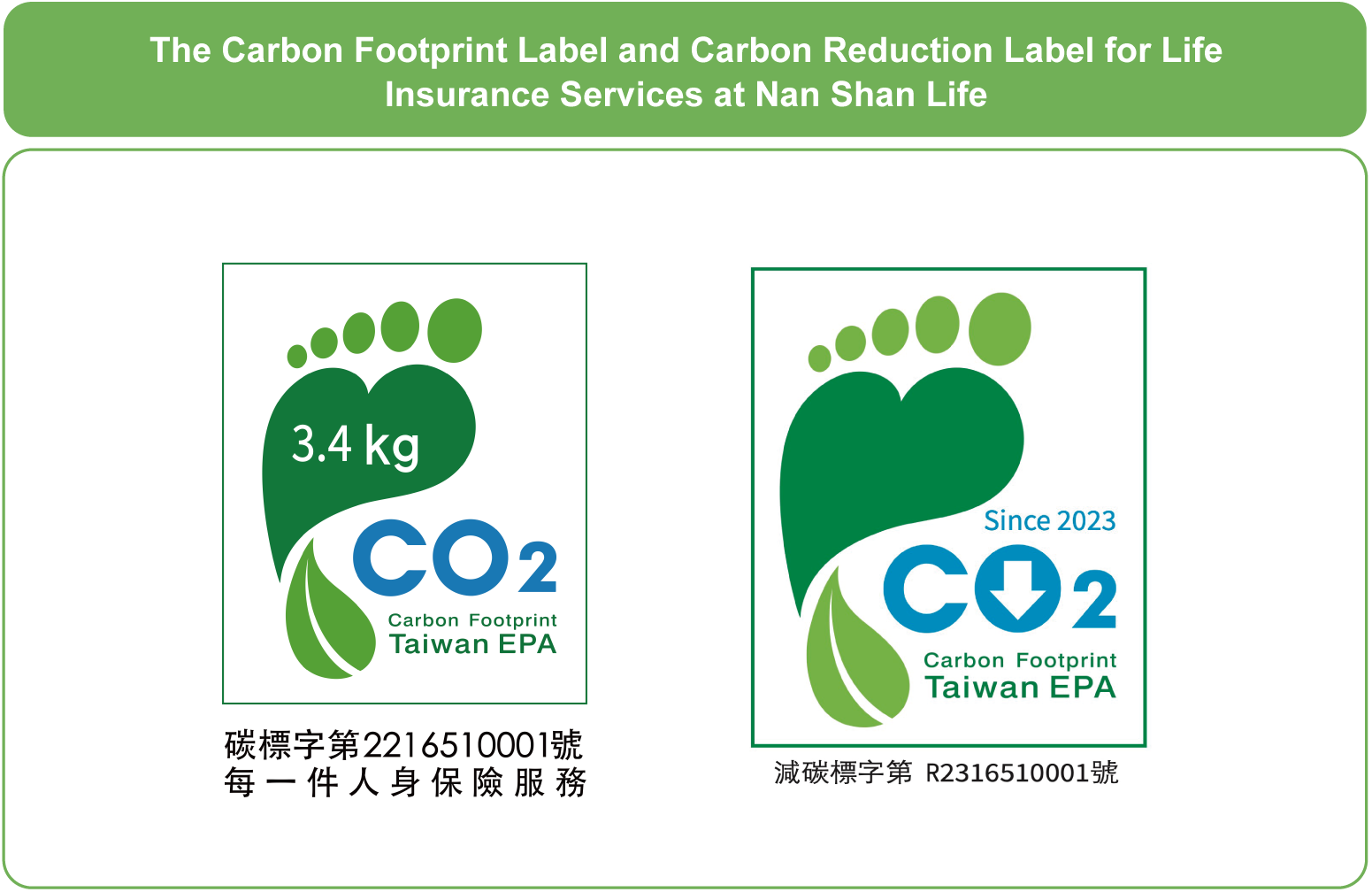

Since 2018, Nan Shan Life has introduced the ISO 14067 Carbon Footprint Standard to the company and analyzed the carbon footprint of life insurance. After receiving the Carbon Footprint Label certificates from SGS-Taiwan and EPA (upgraded and restructured as the Ministry of Environment in August 2023), the Company became the world's first insurance service provider to attain a dual carbon footprint certification. According to the latest inventory results in 2022, Nan Shan Life's policy carbon footprint is 3.16 (kgCO2e/per policy). In addition to obtaining the ISO 14067 certification in 2022, the Company also established a well-defined, comprehensive process for scientifically calculating the carbon footprint from life insurance services within the scope of verification. Not only receiving the EPA's carbon footprint label, the Company also adopted low-carbon transition by largely reduced paper output, promotion of the application of electronic documents and policies, and labor division, thereby met the criteria of a 3% carbon footprint reduction within 5 years, and obtained the Carbon Reduction Label in 2023.

Similarly, the subsidiary company Nan Shan General has also launched its carbon management operations in keeping up with the global trends for net zero carbon emission. After introducing the ISO 14067 Carbon Footprint Standard in 2021, it has completed the "carbon footprint calculation for property insurance services" to obtain the SGS Inventory Verification. In 2022, the Company calculated the carbon footprint from e-policies and became the first general company in Taiwan to pass the carbon footprint verification for e-policies. After receiving the EPA Carbon Label, Nan Shan General became the first financial insurance service provider in Taiwan to be dually certified by the EPA's Carbon Label for property insurance and e-policy. According to the latest carbon footprint inventory results (property insurance services in 2021 and electronic policies in 2022), the carbon footprint of property insurance services is 1.3 (kg-CO2e/per policy) and that of electronic policies is 0.95 (kg-CO2e/per policy).

Similarly, the subsidiary company Nan Shan General has also launched its carbon management operations in keeping up with the global trends for net zero carbon emission. After introducing the ISO 14067 Carbon Footprint Standard in 2021, it has completed the "carbon footprint calculation for property insurance services" to obtain the SGS Inventory Verification. In 2022, the Company calculated the carbon footprint from e-policies and became the first general company in Taiwan to pass the carbon footprint verification for e-policies. After receiving the EPA Carbon Label, Nan Shan General became the first financial insurance service provider in Taiwan to be dually certified by the EPA's Carbon Label for property insurance and e-policy. According to the latest carbon footprint inventory results (property insurance services in 2021 and electronic policies in 2022), the carbon footprint of property insurance services is 1.3 (kg-CO2e/per policy) and that of electronic policies is 0.95 (kg-CO2e/per policy).

In addition, Nan Shan General also responded to the Financial Supervisory Commission's e-policy promotion by rolling out "Electronic Compulsory Insurance Documents" and text message about the delivery of insurance policies to policyholders. It also communicates the benefits of using e-policy to policyholders, since the electronic documents can be stored easily and accessed at any time. Promoted by customer service employees and agents, Nan Shan General's e-policies reached a usage rate of 69.25% by the end of 2023.

Environment for Good

As a maritime nation bounded by the sea, Taiwan is facing severe coastal erosion that has been reducing its physical land area. Nan Shan Life is the first corporation in Taiwan to focus on the coastline erosion. Since 2012, the Nan Shan Ocean Protection activity has been launched to protect the ecosystem on Taiwan’s coastlines for 11 consecutive years. To solve the problem, the Company not only protects the coastline and sea through planned dune fencing, dune fixing, tree planting, beach cleaning, and recycling marine debris art walls, but also invites environmental bureaus from city/county governments to participate in ocean protection activities with local middle or elementary schools, collaborative enterprises, employees, agents, relative and friends, policyholders, and the general public.

Ocean Protection Action