As a large financial and insurance institution in Taiwan, Nan Shan Life is responsible for maintaining domestic financial stability. To ensure capital adequacy and solvency as well as sound business operation and development, Nan Shan Life has established a comprehensive risk management organizational structure, risk management mechanisms and a systematic operation of risk management culture to protect the rights and interests of all policyholders.

Based on the solid foundation of financial soundness, Nan Shan Life will continue to promote awareness of efficient risk control and create value for shareholders and policyholders.

Based on the solid foundation of financial soundness, Nan Shan Life will continue to promote awareness of efficient risk control and create value for shareholders and policyholders.

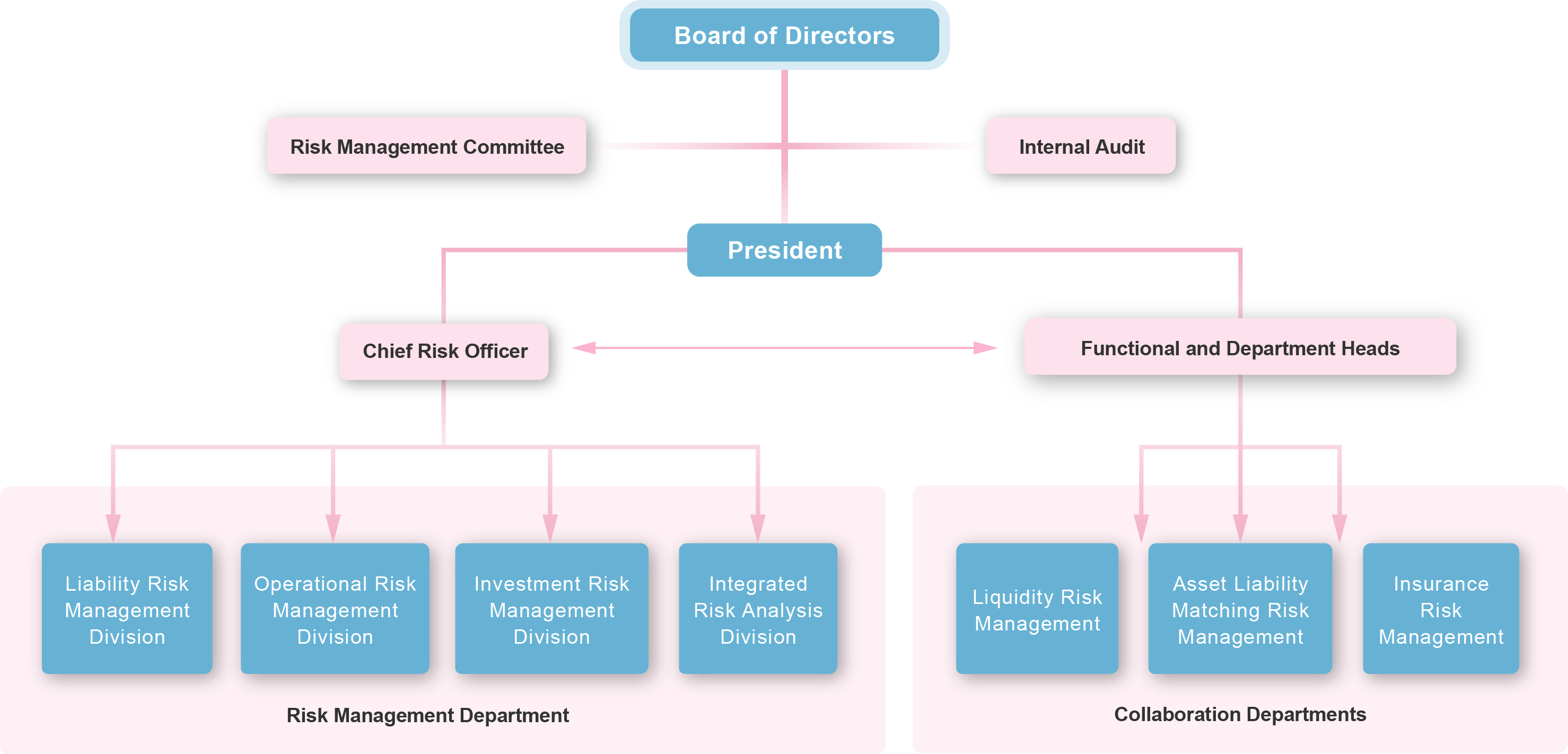

Risk Management Structure

Nan Shan Life's Board of Directors is the company’s highest level of risk management supervision and decision-making hierarchy, within which a dedicated risk management committee has established. An independent director acts as the convener to coordinate risk management matters, and a dedicated department is built up to monitor and manage risk across departments and functions.

The Risk Management Department conducts risk monitoring in accordance with the "Risk Management Policy" set by the Board of Directors, and reports the overall risk profile to the Risk Management Committee and the Board of Directors on a quarterly basis.

The Risk Management Department conducts risk monitoring in accordance with the "Risk Management Policy" set by the Board of Directors, and reports the overall risk profile to the Risk Management Committee and the Board of Directors on a quarterly basis.

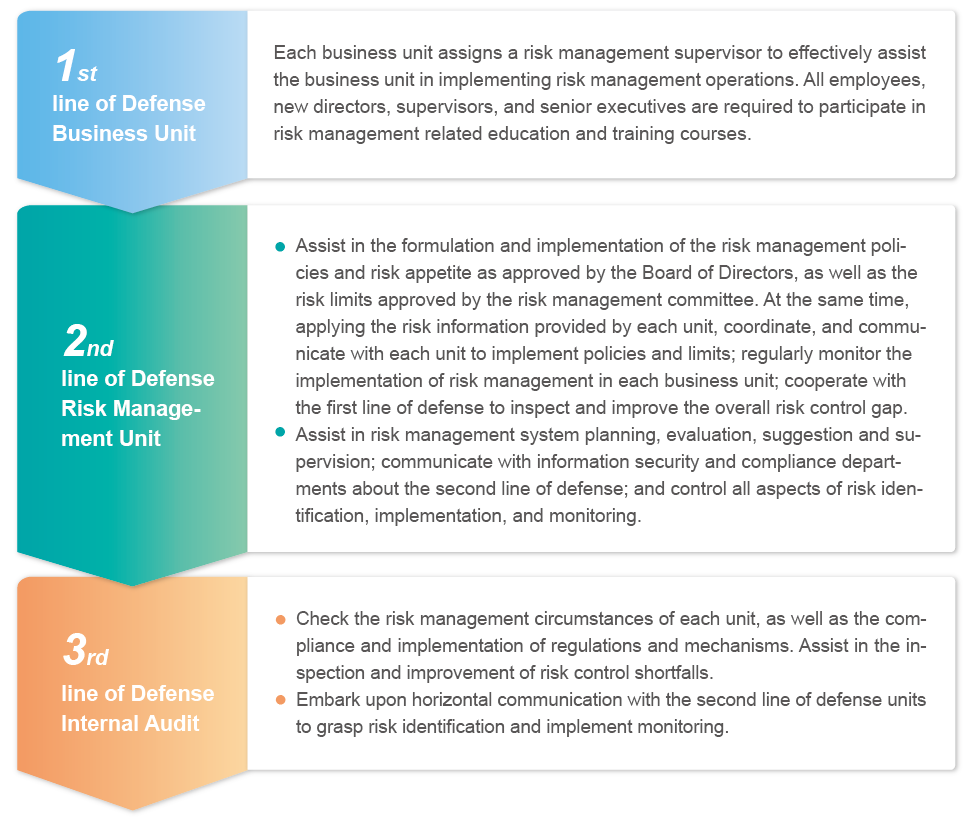

Risk Management and Internal Control

Nan Shan Life implements risk management through a sound internal control system with a three lines of defense mechanism to effectively control operational risks.

The insurance business faces with inherent risks, including market risk, credit risk, operational risk, insurance risk, liquidity risk, asset-liability matching risk, etc. Nan Shan Life rigorously identifies, measures, supervises, and communicates risks through various risk management tools such as risk and control self-assessment (RCSA), key risk indicators (KRI), and market and credit risk measurement systems (Algo) to establish relevant risk control mechanisms and refines internal risk quantification models to ensure effective risk management implementation.

| Risk Category | Method of Management |

|---|---|

| Market Risks | The company manages market risks by means of the Value-at-Risk (VaR). In addition to setting limits for relevant risk factors, stress testing, sensitivity analysis, etc. are used to supplement measurement and monitoring of the company’s market risks. The results are reported regularly to the management team for fully awareness purpose and decision-making process. |

| Credit Risks | The company manages credit risks based on the principle of “management by rating grades and control by exposure limits”, establishing limits based on the country, industry, currency types, and the counter parties, and monitoring such control factors before and after the transaction. In addition, credit risk assessment is conducted regularly, which includes related risk incidents, indicators, and adjusting the credit limits accordingly. |

| Liquidity Risks |

|

| Operational Risks | Through the risk and control self-assessment management tool, the Company identifies and measures the effectiveness of all reasonably expected and significant risk controls in daily operations, and has key risk indicators to continuously monitor risk developments. For projects that exceed the risk threshold, corresponding countermeasures are formulated. In addition, the Company has a reporting mechanism for operational risk events, to timely review and strengthen relevant control. |

| Insurance Risks |

Insurance risks include underwriting, claims, catastrophe, reinsurance, product design and pricing, and risks related to reserves, etc.:

|

| The company measures asset-liability matching risks by examining the asset-liability gap during the testing duration, long-term and short-term cash flow, and cash holding. An asset liability management committee meeting is convened regularly to track and report on the status of the risks. |

A Risk Management Culture

| Item | Content and Nanshan 2023 performance |

|---|---|

| Employees’ proactive identification, notification, and feedback mechanism | To collect and consolidate information on past internal or external loss events as a basis for future risk assessment, the Company has set up "Directions for Notification of Operational Risk Events" for all units to follow. Each business unit should take the initiative to report to the department head and the risk management section of the unit if an operational risk event occurs or is found, and, through the root cause analysis of the event, timely review the control gap and adjust the control mechanism. |

| Employee performance evaluation incorporated into risk management related indicators | The effectiveness of internal control and compliance is included in the performance evaluations of managers and all staff to ensure the effective operation of the risk management system. |

| Risk management training | To establish a comprehensive risk management culture and enhance the risk awareness of staff, the Company provides monthly market risk reports, monthly credit risk reports, quarterly operational risk management reports to relevant executives on a regular basis, and provides online and offline risk management training courses every year. Every new employee is required to take the risk management basic cognitive training course to understand the core concepts of Nan Shan Life’s risk management. In addition, the Company also provides annual risk management courses for employees and risk management executives. In 2023, the Company held one online risk management basic cognition course for all staff, two offline training courses for risk management executives, five training courses on business continuity management, one climate risk management training course for senior executives, and one such course for the TCFD team and risk management executives. |